Credit-Linked Note - QFinance

Credit derivatives include credit default swaps, asset swaps, total return swaps, credit linked notes, credit spread options, and credit spread forwards. In addition .

http://www.qfinance.com/dictionary/credit-linked-note

Credit Derivative

total return swap: Two parties enter an agreement whereby they swap . credit linked note: A debt instrument is bundled with an embedded credit derivative.

http://www.riskglossary.com/articles/credit_derivative.htm

Credit Derivatives Explained - Investing In Bonds

Total Return swaps. 11%. Credit Linked Notes. 10%. Baskets. 6%. Credit Spread products. 5%. Source: British Bankers' Association Credit Derivatives Report .

http://www.investinginbonds.com/assets/files/LehmanCredDerivs.pdf

BaFin - Circulars - Treatment of Credit Derivatives in Principle I ...

total return swaps; credit default swaps; credit linked notes. The inclusion of credit derivatives in Principle I as well as under the large exposures and million .

http://www.bafin.de/SharedDocs/Veroeffentlichungen/EN/Rundschreiben/rs10_99en_ba.html

Step 1

1.2 Product nature of credit derivatives

credit risk. Common types of credit derivatives. 1. Credit default swaps. 2. Asset swaps and total return swaps. 3. Credit spread options. 4. Credit linked notes. 5.

http://www.math.ust.hk/~maykwok/courses/MATH685R/Topic1_1b.pdf

Credit Derivatives

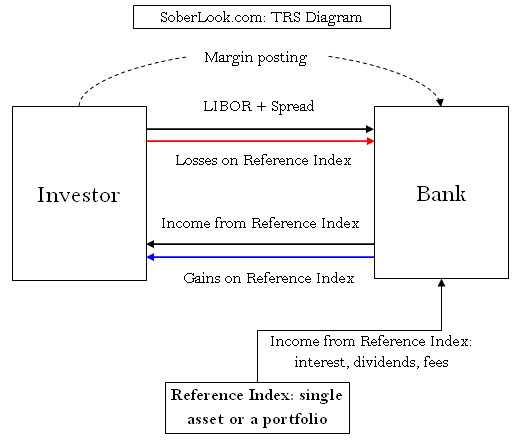

Total return swaps are utilized to transfer credit risks between two parties. Credit Linked Note: The value of a credit linked note depends on the occurrence of a .

http://www.investorguide.com/igu-article-1144-credit-basics-credit-derivatives.html

Step 2

The PricewaterhouseCoopers Credit Derivatives Primer

Total Return. Swaps. 27%. Credit Swaps. 20%. Credit Spread. Options. 15%. Credit-Linked. Notes. 5%. Other. 1%. Credit. Forwards. Source: CIBC Wood Gundy .

http://www.melafrit.com/education/Finance/FinanceConventionnelle/FinanceDeMarche/CERAM/2nd%20Smester/Fixed%20Income/Class%209/crederivativesprimer.pdf

Step 3

Katy Soudmand | LinkedIn

Provided legal and regulatory advice for credit derivatives (CDS) on . (ABS), CDS on indices, bespoke CDS, total return swaps (TRS), credit linked notes .

http://www.linkedin.com/in/katysoudmand

Step 4

An Introduction to Credit Derivatives - YieldCurve.com

o They are bilateral OTS contracts. o Types of credit derivative: o Credit default swap o Total return swap o Credit-linked notes o Credit spread products o Credit .

http://www.yieldcurve.com/Mktresearch/files/LGUCreditDerivs_Jun02.pdf

Step 5

Chapter 14 Credit Derivatives

There are three common forms of credit derivatives, namely, credit default swap, credit linked note and total return swap. Credit default swap. The simplest form .

http://www.hkma.gov.hk/media/eng/publication-and-research/reference-materials/banking/ch14.pdf

Step 6

Revised Guidelines on Derivatives for Insurers - Bank Negara ...

assume or mitigate credit risk of an underlying reference credit. Examples of credit derivatives include credit default swaps, credit-linked notes and total return .

http://www.bnm.gov.my/guidelines/02_insurance_takaful/03_prudential_stds/13_derivatives_gl.pdf

Credit-linked note - Wikipedia, the free encyclopedia

A credit linked note (CLN) is a form of funded credit derivative. . The client then owns the issued security which derives its total return from the underlying .

http://en.wikipedia.org/wiki/Credit-linked_note

References

Photo Credits

- property image by Christopher Hall from yuanta securities investment consulting