Individual - Education Planning

Oct 27, 2010 . The savings bond education tax exclusion permits qualified taxpayers to exclude from their gross income all or part of the . Qualified higher education expenses must be incurred during the same tax year in which the bonds are redeemed. . U.S. Department of the Treasury, Bureau of the Public Debt .

http://www.treasurydirect.gov/indiv/planning/plan_education.htm

Invest FAQ: Bonds: U.S. Savings Bonds for Education

Jan 4, 2006 . Subject: Bonds - U.S. Savings Bonds for Education. Last-Revised: 4 . This is sometimes known as the Tax Free Interest for Education program.

http://invest-faq.com/articles/bonds-us-savings-edu.html

Series EE and I Savings Bonds - FINRA

Savings bonds are another tax-advantaged way to save for college, but you must . U.S. Series EE savings bonds issued after 1989 or Series I saving bonds are . from these bonds is tax-free if used for qualified higher education expenses.

http://www.finra.org/Investors/SmartInvesting/SmartSavingforCollege/P123945

Step 1

FinAid | Saving for College | Savings Bonds

US Savings Bonds offer a low-risk and modest return investment for saving for your . tax free when the bonds are redeemed to pay qualified higher education .

http://www.finaid.org/savings/bonds.phtml

Educated use of savings bonds earns tax break

U.S. savings bonds have always been a popular way to stash cash without a lot of risk. For taxpayers using them to pay college costs, the interest also is tax-free.

http://www.bankrate.com/finance/money-guides/cashing-savings-bonds-can-yield-tax-break-1.aspx

Step 2

Publication 970 (2011), Tax Benefits for Education

Who Can Cash In Bonds Tax Free. You may be able to cash in qualified U.S. savings bonds without having to include in your income some or all of the interest .

http://www.irs.gov/publications/p970/ch10.html

Tax Advantages of Series EE Savings Bonds

There are substantial tax advantages to investing in series ee savings bonds . Free Investing for Beginners Newsletter! . EE savings bonds, the United States Government provides a number of tax benefits that include the ability to pay no taxes on interest income from bonds when used for certain higher education costs.

http://beginnersinvest.about.com/od/eesavingsbonds/a/tax-benefits-of-ee-savings-bonds.htm

Step 3

Using Savings Bonds Tax Free for Higher Education - US Savings ...

Extensive Savings Bond information for US Savings Bond investors using savings bonds for educational tuition for tax free for education. How to properly report .

http://www.savingsbonds.com/bond_basics/education-tax-exclusion-savings-bonds.cfm

Step 4

Using Savings Bonds as Tax-Free College Savings? 7 Things to ...

Mar 28, 2010. to earn tax-free interest on EE savings bonds when used for education . Here's a recent question regarding EE US Savings Bonds, which .

http://www.moneytalksnews.com/2010/03/28/using-savings-bonds-as-tax-free-college-savings-7-things-to-know-first/

Step 5

Ask Kantro: How Do I Roll Over US Savings Bonds into a 529 ...

Feb 13, 2012 . — A.J.K. The interest earned on Series EE US savings bonds . the bonds relatively tax free if cashed and used for qualified educational .

http://www.fastweb.com/financial-aid/articles/3459-ask-kantro-how-do-i-roll-over-us-savings-bonds-into-a-529-college-savings-plan

Step 6

Individual - EE/E Savings Bonds

May 1, 2012 . Is my EE bond eligible for the Education Tax Exclusion? See EE/E Savings . History of U.S. Savings Bonds - Interactive Timeline. As of 2012 .

http://www.treasurydirect.gov/indiv/products/prod_eebonds_glance.htm

Savings Bond college education deduction: US Savings Bonds

Expert answers to your questions about saving for college or .

http://www.savings-bond-advisor.com/savings-bonds/education-deduction/

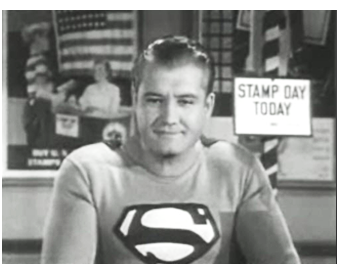

Photo Credits

- property image by Christopher Hall from buywithme good vibrations