Spanish Banks Bleeding Cash Cloud Bailout Debate: Euro Credit ...

2 days ago . “The first consequence of a lower loan-to-deposit ratio being set is . “It also forces you to pay up for deposits, as we have seen in the Irish case.

http://www.bloomberg.com/news/2012-09-17/spanish-banks-bleeding-cash-cloud-bailout-debate-euro-credit.html

Irish Economy | Broadsheet.ie

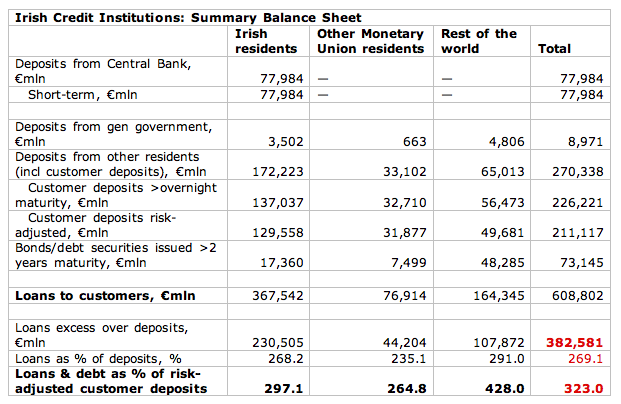

Sep 12, 2012 . Irish Permanent's loans-to-deposits ratio remains 227pc, down from 247pc last year. What this means is that the delinquent management of this .

http://www.broadsheet.ie/tag/irish-economy/

Inside Track: Road to recovery - Business & Finance

Of course, Bank of Ireland is in the middle of a deleveraging programme which aims to bring its loan-to-deposit ratio from 177% to 122%. Ross says this is a .

http://www.businessandfinance.ie/bf/2012/3/newmarch2012/insidetrackroadtorecovery

David McWilliams » Our bailed out banks are in process of going ...

Apr 4, 2012 . Irish Permanent's loans-to-deposits ratio remains 227pc, down from 247pc last year. What this means is that the delinquent management of this .

http://www.davidmcwilliams.ie/2012/04/04/our-bailed-out-banks-are-in-process-of-going-bust-again

Step 1

Government will seek 'ambitious' reduction of ... - The Irish Times

Jul 13, 2012 . The Minister told the Financial Services Ireland lunch that the ESM taking . The troika has agreed to replace the loans-to-deposits ratio targets .

http://www.irishtimes.com/newspaper/finance/2012/0713/1224319967276.html

Sovereigns, Banks, and Emerging Markets: Detailed Analysis ... - IMF

Note: Program countries are Greece, Ireland, and Portugal. SMP = ECB's . loan-to-deposit ratio is replaced by the wholesale funding ratio. Note: Prepared by .

http://www.imf.org/external/pubs/ft/gfsr/2012/01/pdf/c2.pdf

Step 2

Debt Investor Presentation May 2012 - Bank of Ireland

Irish Government, loan to deposit ratios, expected impairment charges, the level of the Group's assets, the Group's financial position, future income, business .

http://www.bankofireland.com/fs/doc/wysiwyg/boi-presentation-may-2012-d303-2.pdf

Bank of Ireland Presentation

Mar 22, 2012 . Irish Government, loan to deposit ratios, expected Impairment charges, the level of the Group's assets, the Group's financial position, future .

http://www.bankofireland.com/fs/doc/wysiwyg/boi-presentation-march-2012-d303-1.pdf

Step 3

IRELAND: ON RECOVERY PATH - NTMA

Deleveraging of domestic banking system. Smaller banking system to better reflect size of Irish economy going forward. •. Target loan to deposit ratio of 122.5 % .

http://www.ntma.ie/Publications/2012/InvestorPresentationIrelandOnRecoveryPathApril2012.pdf

Step 4

Central Bank of Ireland - Financial Measures Programme FAQs

Each bank must meet a liquidity requirement of a target loan to deposit target ratio of 122.5% by 2013, through a combination of run-off and disposals of .

http://www.centralbank.ie/publicinformation/Pages/FinancialMeasuresProgrammeFAQs.aspx

Step 5

Transcript - Lloyds Banking Group

May 1, 2012 . As a consequence, our loan to deposit ratio has improved to 130%, . In Ireland, we continue to increase our already high coverage ratio, .

http://www.lloydsbankinggroup.com/media/pdfs/investors/2012/2012May1_LBG_Q1_IMS_Transcript.pdf

Step 6

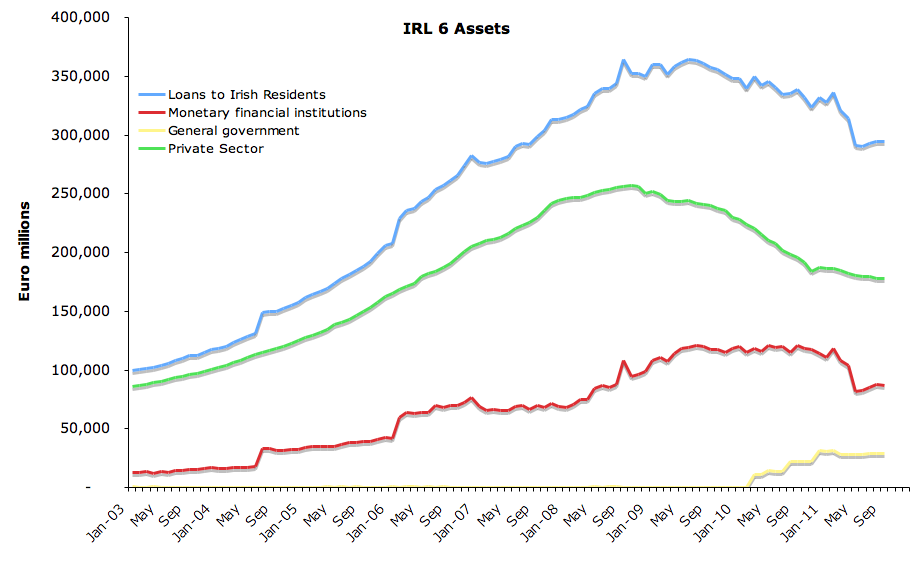

First and Second Reviews April 2011

Jan 24, 2012 . During 2010 the Irish banks and authorities took actions that reduced the size of the banking system, but loan to deposit ratios remained high.

http://ec.europa.eu/ireland/economy/financial_assistance_programme_ireland/troika_review_reports/first_and_second_review_en.htm

Banking in Ireland: Back to the Future - University College Dublin

Ju l-08. Jan. -09. Ju l-09. Jan. -10. Ju l-10. Jan. -11. Ju l-11. 'Pure ' Loan to Deposit Ratio of Irish Covered. Banks. Crisis and Recovery Conference January 2012 .

http://www.ucd.ie/geary/static/podcasts/ieconf/presentations/BrianLucey.pdf

Photo Credits

- property image by Christopher Hall from banking trivia games